Trump hush money ruling explained

And how the jury was influenced to give the wrong verdict

Perspective

Sadly, the US justice system failed in its politically motivated conviction of Donald Trump. This becomes quite obvious when you look more into the case, but the case is unfortunately complicated enough that people can simply align with their side.

I believe that not acknowledging that this case is bogus is a mistake by left-leaning legal commentators and analysts. Yes, the left will score a short-term point by being able to call Trump a “convicted felon”. But this kind of judicial weaponization degrades the legal principles on which free and liberal societies are built.

Overview of the case

Falsifying business records in itself is a misdemeanor, not felony. The charge was elevated to a felony by alleging that the falsification was done with the intent to commit another crime or to aid or conceal the commission thereof.1

This other crime was conspiracy to influence an election by unlawful means.

For the 'unlawful means' crime, there were three options:

1. Campaign Act violation

2. Tax fraud

3. Falsification of business records (again)

Here is a diagram of the case:

There are two major problems with the the three options:

• For each individual option, it is not convincing that it actually constitutes a crime.

• It is not demonstrated, or even likely, that Trump would see these as crimes. (Which is necessary for there to be the potential that Trump could falsify business records in order to conceal what he thinks is another crime.)

Which specific crime Trump allegedly intended to cover up was crucial to the allegation of falsifying business records as a felony. However, the specific crime was not described in the indictment. In the end, the crime was not even uniquely specified. Instead, the jury was presented with the three options above and was allowed to disagree internally about which one it was. The judge bears responsibility for this situation.

On to the three individual options:

Option 1: Campaign Act violation

When Trump's attorney Cohen paid the hush money, this allegedly counts as a donation to the Trump campaign. According to campaign finance law, individual donations exceeding $2,700 have to be registered. Not registering this payment as a donation would therefore be against campaign finance law. A problem with this allegation is that paying hush money should probably not be considered a campaign expense. Brad Smith (@CommishSmith), a former FEC commissioner and subject expert:

Here is a link to the full thread explaining further expanding on this.

It should also be considered that Cohen was reimbursed for the expense. So it is not really a donation as such. But under the law, a campaign contribution can also be in the form of a loan, and since Cohen paid in advance, it could arguably be seen that way.

However, we must remember that what we are looking for is whether Trump thought this was a crime and intended to conceal it by falsifying business records. It does not seem likely that Trump would think that his attorney handling his hush money payment could be seen as a campaign contribution from the attorney.

Furthermore, let's hypothetically assume that Trump did think it was a campaign finance violation for his attorney to initially pay the money and get reimbursed later. In that case, couldn't Trump simply have paid the reimbursement in advance? If Trump had paid the reimbursement in advance, there would be no crime, and no need to falsify business records to conceal it.

Note that Cohen pleaded guilty to this charge in another court case. This doesn't change the actual legality of the matter, but it is relevant for this court case, as I will come back to later.

Option 2: Tax fraud

The alleged tax fraud is that Cohen was reimbursed for the hush money payment through normal income, and therefore paid too much in taxes. Paying too much in taxes can also be considered a form of tax fraud.

However, again one issue is whether this was technically illegal, and another is whether it is likely that Trump falsified his business records in order to cover up this specific supposed crime.

Option 3: Falsification of business records

Since falsification of business records is not a felony, falsifying additional business records shouldn't be either. In fact, the judge agreed with this view and did not allow it as a possible reason to elevate the original charge of falsifying business records to a felony. As the judge stated: "The Court is not convinced that this particular theory fits into the ‘other crime’ element of PL §.175.10."

But nonetheless, it was allowed by the court as an element of the case to support conspiracy to influence an election by unlawful means, since according to the judge it is intertwined with and "advances the other theories discussed."

So, I think it is fair to say that the main alleged crime must be in option 1 or 2, and this one could possibly be used for support.

The jury

It is often claimed or assumed that since the conviction was by jury, it means it is legitimate. But it is important to consider the information the jury is given.

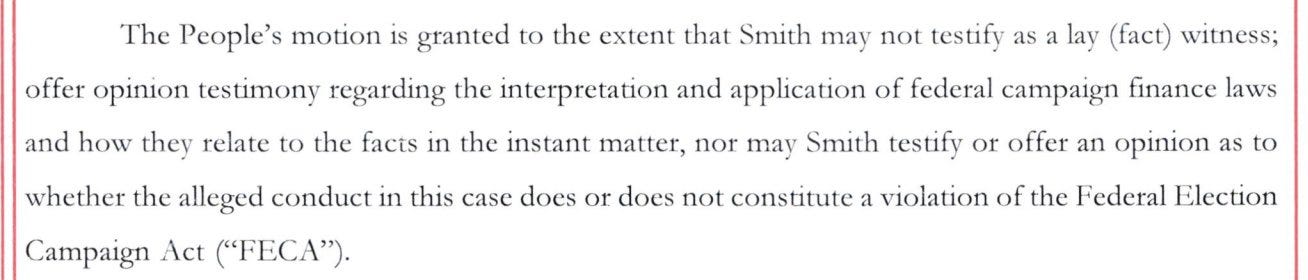

This is especially important regarding option 1, Campaign Act violation. Here, the jury was not provided with a thorough explanation of what constitutes such a violation. In fact, an expert witness (Brad Smith from earlier), was specifically not allowed to be called to testify about the application of campaign finance reform and how it relates to the facts of the case:

It is thus highly possible that the jury had incorrect ideas about what constitutes Campaign Act violations. This is even more likely since the jury was informed (multiple times) about Cohen pleading guilty to the allegations regarding Campaign Act violations. This information is not admissible as evidence, and it is written in the jury instructions that they should disregard it. However, if this had already led the jury to believe that the payment was a Campaign Act violation, instructing the jury to disregard that court case can not undo the preconception.

Andrew McCarthy says this about it in the McCarthy Report podcast: "All of that evidence is not admissible against Trump. Instead of keeping that stuff out, which is what the judge should have done, he let the prosecutor tell the jury about it over, and over, and over again. And the reason for that, I am completely convinced, is that they couldn't prove it as to Trump, so their approach to it was to make the jury think it was an established fact of life - the fact that this Federal Campaign Act violation had occurred."

Addendum: Erlinger v. United States

A recent Supreme Court ruling, Erlinger v. United states, further cemented that the jury must always be unanymous about the underlying crime:

“the ‘truth of every accusation’ against a defendant had to be ‘confirmed by the unanimous suffrage of twelve of [his] equals and neighbors.’” Id. (quoting Apprendi, 530 U.S. at 477).

As described in the Overview of the case above, this was explicitly not the case in the Trump ruling. The judge instructed the jury that they were allowed to consider any or all of the three options for the accusation regarding underlying crime.

From the jury instructions:

”Under our law, a person is guilty of falsifying business records in the first degree when, with intent to defraud that includes an intent to commit another crime or to aid or conceal the commission thereof, that person: makes or causes a false entry in the business records of an enterprise.”

Link to jury instructions